IFRS 15 5 Step Model ESTABLISHES the criteria on the basis of which ‘Revenue from Contracts with Customers‘ is recognized, effective from 1st January 2018 and replaced IAS 18, IAS 11, SIC 31, IFRIC 13, IFRIC 15, and IFRIC 18.

International Financial Reporting Standards (IFRS) has PROVIDED IFRS 15 Five Step Model for ‘revenue recognition‘.

IFRS 15 5 Step Model

Step 1: Identify the Contract with the Customer

IFRS 15 Contract

A ‘Contract’ is an agreement between two or more parties that creates enforceable rights and obligations. It can be Written, Oral, or Implied by an entity’s customary business practices.

Attributes

IFRS 15 requires Contracts to have the following attributes:

- Parties approve the contract and are committed to performing their respective obligations.

- Each party’s rights to goods/services can be identified.

- Payment terms for goods/services can be identified.

- The contract has commercial substance, AND

- It is probable that the consideration will be received (Evaluate customer’s ability and intention to pay).

If an Attribute is Missing

If a Contract does NOT meet any of the above conditions, ‘Revenue’ is recorded only when either:

- The entity’s performance is complete and substantially all of the consideration (cash) has been collected and it is non-refundable; OR

- The contract has been terminated and the consideration received is non-refundable.

No Contract

If each party to the contract has a unilateral enforceable right to terminate a wholly unperformed contract without compensating the other party/parties, NO contract exists under IFRS 15.

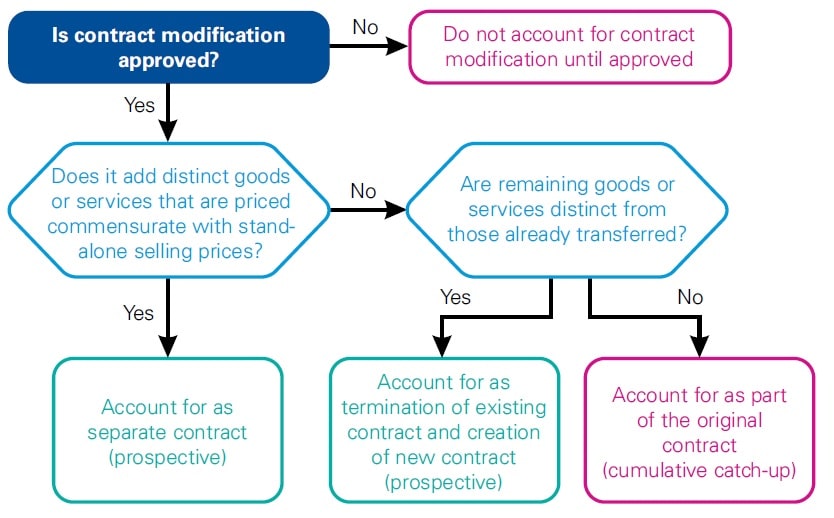

IFRS 15 Contract Modification

A CHANGE in enforceable rights and obligations (i.e. scope and/or price) is accounted for as a Contract Modification only if:

- It has been approved by the parties; AND

- Creates new or changes existing enforceable rights and obligations.

Step 2: Identify the Performance Obligation

Performance Obligation

‘Promise in a Contract’ to transfer to the customer either:

- Goods/Services (or bundle of goods/services) that are distinct; OR

- Series of distinct goods/services that are substantially the same and have the same pattern of transfer to the customer.

Performance obligation can be both ‘Explicit‘ (Specifically mentioned in the contract) and ‘Implicit‘ (Based on the entity’s practices and policies). If there is no transfer to the customer, then there is NO ‘Performance Obligation‘.

What is Distinct?

Following criteria to be fulfilled to declare goods/services as ‘Distinct‘:

- Customers can benefit from goods/services either on their own or together with other resources that are readily available to the customer; AND

- A promise to transfer goods/services is separable from other promises in the contract i.e.

| (a) The entity is NOT using goods/services as an input to produce or deliver combined output. |

| (b) The goods/services do NOT significantly modify or customize other goods/services. |

| (c) The goods/services are NOT highly dependent on other goods/services in the contract. |

[Assessment of whether goods/services are ‘DISTINCT’ requires judgment and consideration of all relevant facts and circumstances.]

Step 3: Determine the Transaction Price

Transaction Price

The ‘Transaction Price‘ is the amount of consideration an entity expects to be entitled to in exchange for goods/services but does not include amounts collected on behalf of 3rd parties e.g. sales tax.

The following factors REQUIRE consideration as they affect the Nature, Timing, and Amount of transaction price:

- Non-Cash Consideration;

- Consideration Payable to the Customer;

- Significant Financing Component; AND

- Variable Consideration.

Non-Cash Consideration

- It is accounted for at its Fair Value.

- If fair value is NOT reliably determinable, it is measured at stand-alone selling prices of goods/services.

Consideration Payable to the Customer

- It includes cash paid/payable to customers and credits or other items such as coupons and vouchers.

- It is accounted for as the reduction in transaction price UNLESS payment is in exchange for the goods/services received from the customer. However, Where:

| Consideration paid > Fair Value of goods/services received from the customer: ‘Difference’ is accounted for as a reduction in the transaction price. | Fair Value of goods/services cannot be reliably determinable: ‘Full amount’ is accounted for as a reduction in the transaction price. |

Significant Financing Component

- If the timing of payments specified in the contract provides either customer or entity with significant benefits of financing the transfer of goods/services, the transaction price is adjusted to reflect the ‘Significant Financing Component’ of the contract.

- It can either be Explicitly stated in the contract or Implied by payment terms agreed between parties.

- Adjustment for the effect of the ‘Significant Financing Component’ is NOT required if the period between transfer and payment is 12 months or less.

- FACTORS to consider in determining whether a contract contains a ‘Significant Financing Component‘ are:

| (a) Difference between promised consideration and cash selling price. | (b) Length of time between the transfer of control of the goods or services and payment. |

A ‘Significant Financing Component’ does NOT exist when:

- Timing of Transfer of control of goods/services is at the customer’s discretion.

- Consideration is Variable and the amount or timing of consideration is based on factors outside the control of parties.

- Difference between Consideration and Cash Selling Price arises from other Non-Financing Reasons (e.g. performance of post-completion remedial work).

Variable Consideration

It INCLUDES the following:

- Discounts;

- Rebates;

- Refunds;

- Concessions;

- Incentives;

- Performance Bonuses;

- Penalties; AND

- Contingent Payments.

It must be ESTIMATED using either:

| Expected Value Method | Single Most Likely Outcome |

|---|---|

| It is based on the probability of weighted amounts within a particular range. | Amount within a range that is most likely to eventuate. |

[Transaction price can INCLUDE Variable Consideration only if it is highly probable that subsequent change in the estimate would NOT result in reversal of revenue.]

Step 4: Allocate the Transaction Price to Each Performance Obligation

Whether ‘Stand-Alone Selling Price’ of each performance obligation is directly observable or not?

| Yes | No |

| ‘Allocate‘ the transaction price to each performance obligation based on the stand-alone selling price. | ‘Estimate‘ the stand-alone selling price of each performance obligation by considering all available information including Market Conditions, Entity-Specific Factors, and Information about Customers or Class of Customers. |

| It should be determined at contract inception and represents the price at which an entity would sell a good/service separately to the customer. | Use of observable inputs to be maximized to the extent possible. |

| Ideally, it will be an observable price at which an entity sells similar goods/services under similar circumstances and to similar customers. |

How to Estimate the Stand-Alone Selling Price?

The following APPROACHES are used to estimate the ‘Stand-Alone Selling Price’ of goods/services:

- Market Assessment Approach;

- Expected Cost Plus Markup/Margin Approach; AND

- Residual Value Approach.

Market Assessment Approach

- ‘Evaluate the Market‘ in which goods or services are sold.

- ‘Estimate the Price‘ that the customers in the market would be willing to pay.

- ‘Refer to the Prices from Competitors‘ for similar goods/services adjusted for entity-specific costs and margins.

Expected Cost Plus Markup/Margin Approach

‘Estimate‘ the expected costs of satisfying the performance obligation adjusted for an appropriate markup/margin.

Residual Value Approach

Total transaction price is LESS than the sum of the observable stand-alone selling prices.

It May only be USED when:

| Selling price is highly variable; OR |

| Selling price is UNCERTAIN (Price has not yet been established for such goods/services or such goods/services have not been previously sold.) |

Allocation of Discounts

- A ‘Discount’ exists if the sum of stand-alone selling prices of each of the performance obligations in the contract EXCEEDS the total consideration for the contract.

- A ‘Discount’ is allocated on a proportionate basis to all performance obligations in the contract unless there is observable evidence that the discount relates to a SPECIFIC performance obligation in the contract.

Allocation of Variable Consideration

It should be allocated proportionately to all performance obligations.

However, ‘Variable Consideration’ is allocated ENTIRELY to a single performance obligation if:

| (a) Terms of ‘Variable Consideration’ relate specifically to satisfying that performance obligation; AND |

| (b) Allocation is consistent with the allocation objective. |

Step 5: Recognize Revenue on Satisfaction of Each Performance Obligation

‘Performance Obligation is Satisfied’ when control of the promised goods/services is transferred to the customer.

Performance obligation is satisfied (Control is transferred) hence, revenue is RECOGNIZED:

| Over Time | At a Point in Time |

Performance obligation is SATISFIED (Control is transferred) ‘Over Time‘ if any of the following conditions are being MET:

| (a) Customer simultaneously receives and consumes all of the benefits as the entity performs; OR |

| (b) Entity’s performance creates or enhances an asset controlled by the customer; OR |

| (c) Entity’s performance does NOT create an asset with an alternative use to the entity; AND Entity has an enforceable right to the payment for performance completed to date. |

| Over Time | At a Point in Time |

|---|---|

| RECOGNIZE revenue in a way that depicts the entity’s performance in transferring control of goods/services to the customers. ‘Methods‘ INCLUDE: | CONSIDER the following factors in evaluating the point in time at which control of the asset has been transferred to the customer: |

| (a) Output Method | (a) Entity has transferred Title to the asset; |

| (b) Input Method | (b) Entity has transferred Physical Possession of the asset; |

| (c) Entity has a Present Right to the payment for the asset; | |

| (d) Customer has Accepted the asset; AND | |

| (e) Customer has the Significant Risks and Rewards of Ownership of the asset. |

Synopsis – IFRS 15 5 Step Model

‘Revenue from Contracts with the Customers‘ effective 1st January, 2018 ESTABLISHED the criteria for ‘Revenue Recognition‘ EXPLAINED by IFRS 15 5 Step Model.

By applying these 5 steps, entities AIM to provide useful and consistent information about the nature, amount, timing, and uncertainty of revenue. The GOAL is to reflect the transfer of ‘Goods/Services’ to customers in a way that accurately depicts the consideration to which the entity expects to be entitled.

(Qualified) Chartered Accountant – ICAP

Master of Commerce – HEC, Pakistan

Bachelor of Accounting (Honours) – AeU, Malaysia