IFRS 16 Sub-Lease DEPICTS that such transaction is accounted for by the sub-lessor in the same way as other leases. Under IFRS 16 the head lease and sublease are SEPARATE contracts that are accounted for under the ‘Lessee and Lessor Models‘.

The sub-lease is classified by reference to the Right of Use (RoU) asset.

IFRS 16 Sub-Lease

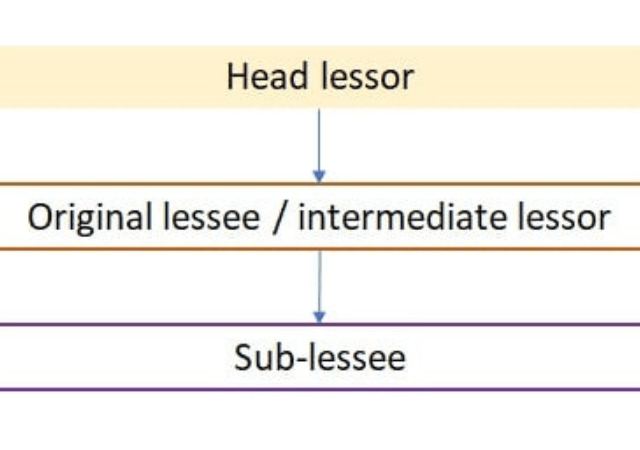

A transaction in which the underlying asset is re-leased by a lessee (Intermediate Lessor) to a 3rd party and the lease (Head Lease) between the head lessor and the lessee remains in effect.

| [Concept of Sub-Lease] |

|---|

| (a) Intermediate lessor shall account for the head lease and sub lease as two separate contracts, applying BOTH ‘Lessee and Lessor Accounting‘. |

| (b) Intermediate lessor shall CLASSIFY the sub-lease as finance lease or operating lease with respect to the Right of Use (RoU) asset arising from head lease i.e. right of use asset is treated as an underlying asset in sub-lease, not property, plant, and equipment that it leases from the head lessor. |

| (c) At the ‘Commencement of Sub-Lease’, if the intermediate lessor CANNOT readily determine the rate implicit in the sub-lease then it uses the discount rate of the head lease to account for sub-lease adjusted for any initial direct costs associated with the sub-lease. |

1. Accounting by the Original Lessee/Intermediate Lessor

| If Head Lease is Accounted for Under IFRS 16 | If Head Lease is Accounted for as an Exception from IFRS 16 |

| Sub-Lease is ‘Operating Lease‘: – Keep recognizing the RoU asset and lease liability of the head lease. – Recognize lease income from sub-lease on straight-line basis (or another systematic basis) over the lease term. Sub-Lease is ‘Finance Lease‘: – De-recognize RoU asset of head lease transferred to sub-lease and recognize net investment in the sub-lease with any difference in P&L. – Keep recognizing the lease liability of the head lease. – During sub-lease, recognize both finance income on sub lease and interest expense on the head lease. | – If the head lease is accounted for as a short-term lease, the intermediate lessor shall classify the sub-lease as operating lease. – If a lessee subleases an asset, or expects to sub-lease an asset, the head lease does NOT qualify as a lease of low-value asset. |

Synopsis

IFRS 16 Sub-Lease occurs when a lessee (the original lessee) grants another party the right to use (RoU) the leased asset for a period within the lease term. It’s essential for entities to carefully assess and account for ‘sub-leases’ in accordance with IFRS 16 to ensure compliance and accurate financial representation.

(Qualified) Chartered Accountant – ICAP

Master of Commerce – HEC, Pakistan

Bachelor of Accounting (Honours) – AeU, Malaysia