Lessee Accounting a concept that DEPICTS the way by which a company records the financial impacts of its leasing activities. As per IFRS 16, Lessees recognize ‘Right of Use’ Asset (RoU) and ‘Lease Liability’, reflecting the present value (PV) of future lease payments.

Table of Contents

IFRS 16 (Leases) – Objective

The ‘objective‘of IFRS 16 is to report information that (a) faithfully represents lease transactions and (b) provides a basis for users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases.

1. IFRS 16 Key Terms

1.1 Lease

A ‘Contract’ that conveys the Right of Use (RoU) an asset for a period of time in exchange for consideration.

1.2 Right of Use

Throughout the period of use, the lessee has BOTH of the following rights to the identified asset:

| The right to OBTAIN substantially all the economic benefits from the use of assets; AND |

| The right to DIRECT the use of the asset: (a) Decision about why and how to use the asset; AND (b) Protective rights do not limit the right to direct the use. |

1.3 Identified Asset

Throughout the period of use, the lessee has BOTH of the following rights to the identified asset:

| Explicit | Implicit |

1.4 Lease Term

Lease term INCLUDES the following:

- Non-cancellable period of the lease;

- Period covered by the option to extend (If the lessee is reasonably certain to exercise the option); AND

- Period covered by the option to terminate (If the lessee is reasonably certain not to exercise the option).

1.5 Lease Payment

These are the ‘payments‘ made by the lessee to a lessor for the Right to Use (RoU) an underlying asset during the lease.

It INCLUDES:

| Fixed Payments LESS any lease incentive receivables; |

| Variable Lease Payments that are dependent on an index or rate; |

| Residual Value Guarantees; |

| Exercise Price of reasonably certain purchase options; AND |

| Lease Termination Penalties. |

IFRS 16 Lessee Accounting – Balance Sheet (Classification)

IFRS 16 clarifies that there’s NO classification of the lease from the lessee’s perspective rather lessee recognizes the right of use an asset and corresponding lease liability.

1. Commencement of Lease

When the lessor makes available the underlying asset to the lessee for use;

| Debit: Right of Use Asset | Credit: Lease Liability |

|---|---|

| Amount of Lease Liability; | Lease payments NOT made at the commencement date are discounted at the appropriate Discount Rate. |

| Lease payments made at or before the commencement date LESS any lease incentives; | |

| Initial direct costs (Lessee) AND; | |

| Dismantling costs – Estimates |

2. Depreciation of Right of Use Asset

| If it is Certain that the asset will be transferred to the lessee | If it is NOT Certain that the asset will be transferred to the lessee |

|---|---|

| Over the useful life of the asset. | Over the LOWER of: – Useful life of the asset; OR – Lease term. |

3. Initial Direct Costs

‘Incremental Costs’ of obtaining a contract that would NOT have been incurred without the lease.

| Types | |

|---|---|

| Legal fees (Contract drafting) | Yes |

| Commissions | Yes |

| Internal costs | No |

| Certain legal advice for selecting the lease | No |

4. Discount Rate

| For Lessor | For Lessee |

|---|---|

| ‘Interest Rate Implicit in the Lease‘. [Present value of lease payments + Present value of un-guaranteed residual value = Fair value of underlying asset + Lessor’s initial direct cost] | ‘Interest Rate Implicit in the Lease‘. |

| If Interest rate implicit in the lease is NOT available, ‘Incremental Borrowing Rate of Lessee‘. |

5. Variable Lease Payment

Do they depend on the index or rate?

| Yes | No |

|---|---|

| INCLUDE in the lease payment. | EXCLUDE from the lease payment. |

| Measured at the rate prevalent at the measurement date. | Record in Profit & Loss in the period in which they arise. |

Lessee Accounting – Optional Exemptions (As Per IFRS 16)

IFRS 16 (Leases) Optional Exemptions can be APPLIED to the following:

| Short Term Lease – Can be applied to leases with a lease term < 12 months – Cannot be applied to leases containing a purchase option – Apply the exemption by class of underlying asset [A class of underlying asset is a grouping of underlying assets of a similar nature and use in an entity’s operations.] | Lease of Low-Value Assets – Can be applied to leases for low value items i.e. assets with a value of USD 5,000 or less – Apply the exemption on lease by lease basis – Exemption cannot be applied: (a) If the underlying asset is highly dependent or interrelated with other assets; (b) If lessee cannot benefit from using the underlying asset on its own or with other readily available resources; (c) To the head lease in a sublease arrangement; OR (d) If the nature of underlying asset when new is not typically low value. |

1. Accounting for Exempt Leases

| The lessee shall RECOGNIZE the lease payments as an expense on straight line basis over the lease term (or by another Systematic basis). |

| No balance sheet assets and liabilities (OTHER than prepaid and accrued lease payments). |

| DISCLOSE expense relating to each exemption in the notes to the ‘Financial Statements’. |

Lease Reassessment

Lease Reassessment (i.e. lease liability and right of use asset) arises from REVISION in estimates and judgement(s) made on ‘initial recognition‘ of the lease.

| [(a) When there is change in original assessment of Lease Term; OR (b) When there is change in original assessment of Exercise of Bargain Purchase/Termination Options] | [(a) When there is change in estimate of Guaranteed Residual Value; OR (b) When there is change in Future Lease Payment due to change in index/rate] |

| Remeasure lease liability using revised estimate of lease term and cash flows discounted at ‘Revised Interest Rate‘. | Remeasure lease liability using revised estimate of lease term and cash flows discounted at ‘Original Interest Rate‘. |

Re-Measurement of lease liability is ADJUSTED against the carrying value of Right of Use (RoU) asset.

Therefore, there is NO immediate ‘Gain/Loss‘.

However, if reduction in carrying value of lease liability > carrying value of RoU asset, the asset is reduced to ‘zero’ and excess reduction in lease liability is recognized in Profit & Loss.

| Debit: ROU Asset Credit: Lease Liability | Debit: Lease Liability Credit: ROU Asset Credit: P&L (Profit and Loss) |

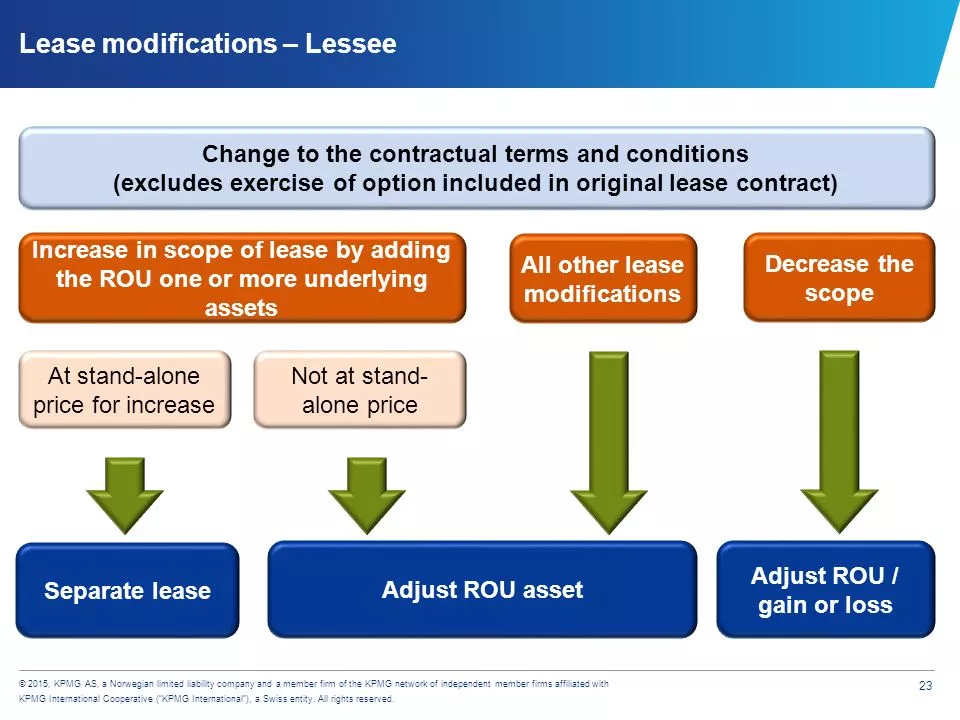

Lease Modification

Lease Modification means Change in Scope or Consideration of lease that was NOT part of the original terms and conditions of the lease.

For Example,

- Adding or terminating the Right to Use one or more underlying assets; OR

- Extending or shortening the contractual lease term.

ACCOUNTING for Lease Modification depends on whether the modified terms increase or decrease the the scope of the lease, and whether the consideration for increase in scope commensurate with a ‘standalone price‘ for the new scope of the lease.

Synopsis

IFRS 16 DEPICTS the way the Lease Transactions are accounted for in the ‘Financial Statements’ and it replaced IAS 17, IFRIC 4, SIC-15 & SIC-27.

Lessee Accounting STATES that lessees are required to recognize virtually all leases on their ‘Balance Sheet‘, eliminating the IAS 17 classification as Operating and Finance leases. Lessees recognize ‘Right of Use’ Asset (RoU) and ‘Lease Liability’, reflecting the present value of future lease payments.

(Qualified) Chartered Accountant – ICAP

Master of Commerce – HEC, Pakistan

Bachelor of Accounting (Honours) – AeU, Malaysia