IFRS 16 Sale and Leaseback a Concept which EXPLAINS that such transaction is accounted for as a ‘sale‘ of an underlying asset and a ‘leaseback‘ of that underlying asset only if the initial transaction QUALIFIES as a sale in accordance with IFRS 15 ‘Revenue from Contracts with Customers‘.

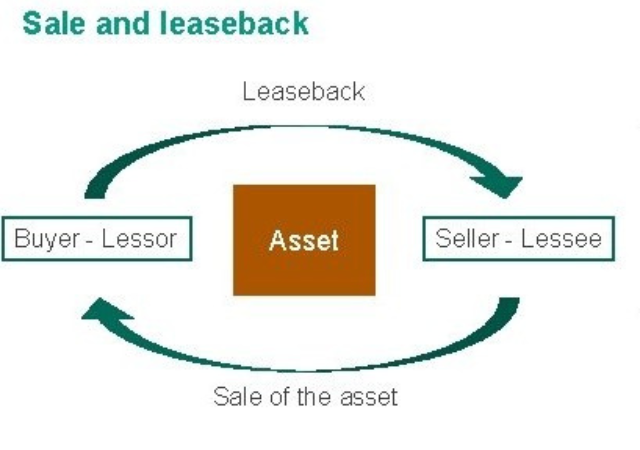

In a ‘Sale and Leaseback transaction’, an entity (the seller-lessee) sells an asset to another entity (the buyer-lessor), which then leases the asset back to the seller-lessee.

Table of Contents

IFRS 16 Sale and Leaseback – Accounting

| ‘Accounting’ of IFRS 16 Sale and Leaseback Transactions depends on whether the transfer of an underlying asset from seller-lessee to buyer-lessor is a sale under IFRS 15? |

How to CONCLUDE whether the transfer of an underlying asset from seller-lessee to buyer-lessor is a ‘Sale’ under IFRS 15?

| Evaluate the Leaseback Transaction from the Perspective of Buyer-Lessor |

|---|

| (Ref. Next Table) |

| If the leaseback is ‘Finance Lease‘ from the perspective of buyer-lessor: – Transfer of an asset from seller-lessee to buyer-lessor is NOT a sale under IFRS 15. | If the leaseback is ‘Operating Lease’ from the perspective of the buyer-lessor: – Transfer of an asset from seller-lessee to buyer-lessor is a sale under IFRS 15. |

| Transfer to buyer-lessor is Not Sale | Transfer to buyer-lessor is Sale |

|---|---|

| Seller-Lessee: – Continue to recognize the underlying asset. – Recognize Financial Liability under IFRS 9 for any amount received from buyer-lessor. Buyer-Lessor: – Do NOT recognize the underlying asset. – Recognize Financial Asset under IFRS 9 for any amount paid to the seller-lessee. | Seller-Lessee: – De-recognize the underlying asset. – Apply the Lessee Accounting to the leaseback. (Ref. Next Table) Buyer-Lessor: – Recognize the underlying asset. – Apply the Lessor Accounting to the leaseback. |

1. Accounting Treatment for Seller-Lessee

[Transfer of ‘Underlying Asset‘ from Seller-Lessee to Buyer-Lessor is a Sale Under IFRS 15]

| Leaseback Accounted for Under IFRS 16 (a) Recognize lease liability at present value (PV) of lease payments (b) Recognize the Right of Use (ROU) asset as a proportion of the carrying amount of asset retained by seller-lessee: [ROU Asset = Carrying Amount of Asset * PV of Lease Payments/FV of Asset] (c) Recognize sale at fair value (d) Recognize gain/loss that relates to rights transferred to buyer-lessor [Gain/Loss = (FV-Carrying Amount of Asset) * (FV-PV of Lease Payment)/FV of Asset] If Sale Proceeds > Fair Value difference being accounted for as ‘Additional Financing‘ provided by buyer-lessor to seller-lessee. If Sale Proceeds < Fair Value difference being accounted for as ‘Prepayment of Lease Payments‘. | Leaseback Accounted for as: – Short Term Lease; OR – Low-Value Asset (a) Recognize any gain/loss as a difference between sale proceed and carrying amount of underlying asset. (b) Recognize lease payments as an expense on Straight-Line Basis (or another systematic basis) over the lease term. |

Synopsis

In IFRS 16 Sale and Leaseback Transaction, an entity sells an asset to a third party and then immediately leases it back. Under IFRS 16, such transactions are accounted for based on the principles of control and transfer of the underlying asset. The ‘Seller-Lessee’ recognizes any Profit or Loss (P&L) from the sale only to the extent of the ‘Buyer-Lessor’s rights, and any excess is deferred.

Chartered Accountant – ICAP

Bachelor of Accounting (Honours) – AeU, Malaysia